This pay type is usually reserved for insurance but can be used towards any taxable fringe benefit received by a shareholder owning more than 2% stake in the company. For example, this is where you will find the Insurance Benefits Taxable pay type. The Imputed/Other tab is where OnPay keeps its most customizable and specialized pay options. Because of this, pay items entered under this tab will not flow through to any forms or documents. Non-reported is for – you guessed it – payments that go unreported on any taxes or other annual reports, such as reimbursements for gas or other operating expenses. These are also consolidated into a single 1099 at the end of the year for your convenience. You’ll be able to customize the wages for your 1099 contractors, too, under the appropriately named 1099 Wage tab. No matter the pay type, this information will flow straight to their W-2 at year’s end. However, OnPay gives you the freedom to personalize your options based on your needs, such as assigning two different employment roles with different pay rates to the same individual. W-2 Wages are paid out like any other employee. You will make these entries beneath one of four categories – W-2 Wages, 1099 Wages, Non-Reported, and Imputed or Other. This can be useful for one-off transactions such as commissions, bonuses, or reimbursements. However, selecting non-hourly lets you enter a freeform, flat amount. Hourly works like you would expect it to – it calculates wage based on hours.

The first of these options to be aware of are the “hourly” and non-hourly” options.

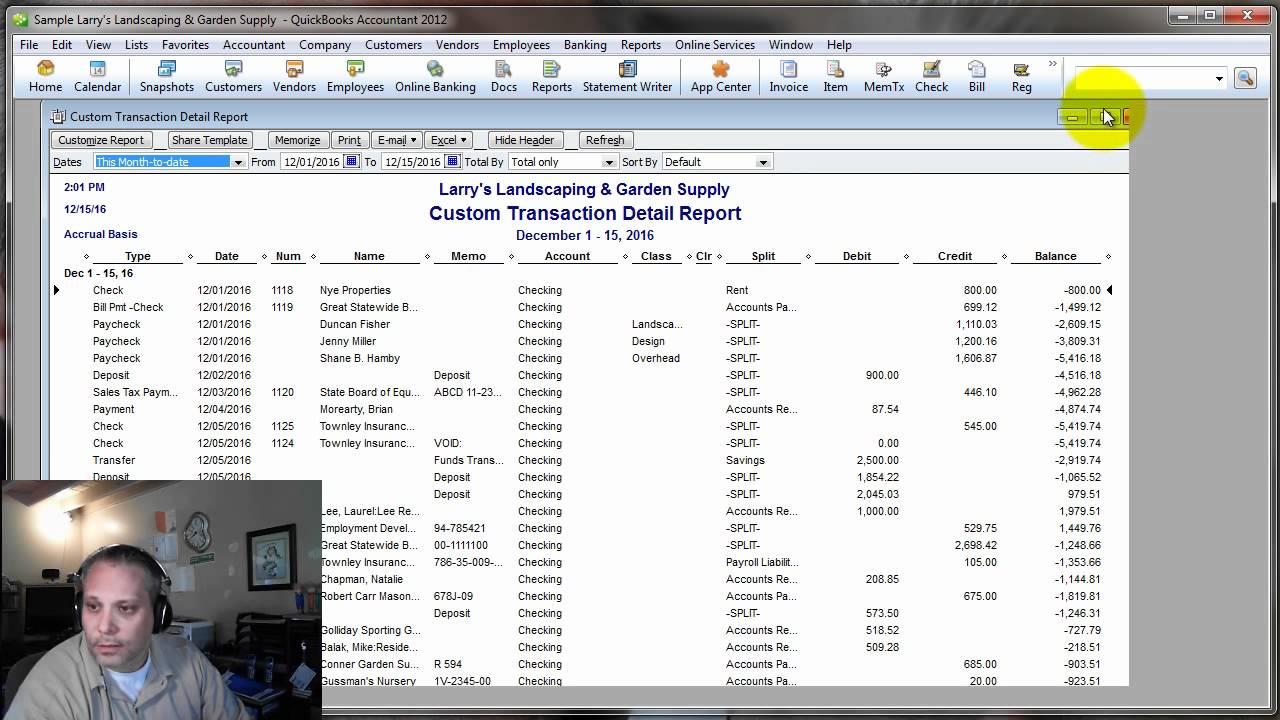

#REMOVING FEINS FROM MY QUICKBOOKS PAYROLL SERVICE SOFTWARE#

OnPay’s software gives LLCs a lot of flexibility when it comes to paying their employees for a job well done.

0 kommentar(er)

0 kommentar(er)